The Ultimate Guide To Paul B Insurance Medicare Explained

Wiki Article

The Basic Principles Of Paul B Insurance Medicare Explained

Table of ContentsPaul B Insurance Medicare Explained Can Be Fun For EveryoneSome Known Details About Paul B Insurance Medicare Explained The Main Principles Of Paul B Insurance Medicare Explained Getting The Paul B Insurance Medicare Explained To WorkOur Paul B Insurance Medicare Explained Statements

Keeping your ACA strategy might likewise mean dealing with late registration fines for Medicare in the future. If you have an Affordable Care Act (ACA) plan, you can keep your protection once you transform 65. You can not maintain any kind of exceptional tax credit scores (or aids) as soon as your Medicare Part A coverage begins.Or else, you might be required to pay them back when filing your tax obligations. If you benefit a company with 1-50 workers, you might have the ability to maintain your company insurance coverage via store.7 Maintaining this strategy will enable you to delay Medicare enrollment. You will not be subject to late registration charges until hereafter coverage finishes.

If it will certainly end up being an additional protection option, it may remain in your benefit to enroll in Medicare when you are first eligible. Otherwise, your employer insurance coverage may refuse making settlements up until Medicare has been billed. This might place you in an expensive, and also frustrating, insurance coverage hole - paul b insurance medicare explained.

You may encounter added prices if you postpone enlisting in a Medicare Supplement strategy. It is necessary to keep in mind that just specific strategies allow you to delay registering in Medicare without encountering penalties. Medicare Part A Many people obtain premium-free Component A because they have functioned for at least one decade in America.

The Facts About Paul B Insurance Medicare Explained Uncovered

Your regular monthly costs can enhance by 10% for each and every year you didn't sign up. This fine lasts for twice as several years as you postponed insurance coverage. 8 As an example, if you postponed signing up in Medicare for 4 years, you'll have to pay a greater premium for eight years. Medicare Component B The Component B penalty is a long-lasting consequence to delaying your Medicare protection.9 For instance, if your IEP ended in December 2017, as well as you waited until March 2020 to enroll in Component B, you would certainly run into a 20% costs charge (two complete 12-month periods without coverage). Medicare Part D The Part D charge is likewise lifelong and begins when you have actually had no prescription medicine coverage for more than 63 days.

37 in 2022) for each month you were not covered. 10 For instance, if you went without prescription drug insurance coverage from December 2020 through February 2022 (14 months), that's a 14% fine, or $4.

pop over to this web-site

That's since you certify to enlist in a Medigap strategy with no medical underwriting throughout your IEP. After this time has actually ended, your clinical background, age, as well as other variables can be utilized to raise your premium. You can also be denied protection based on your health. Deciding in between Medicare vs.

Indicators on Paul B Insurance Medicare Explained You Should Know

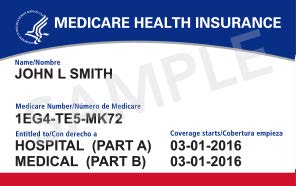

Health, Markets can aid you get Medicare prices quote online and contrast them to your current coverage, at no charge to you. Contrast premiums, out-of-pocket expenses, as well as health insurance coverage. And also, Health, Markets can also aid you figure out which plan finest suits your demands. Answer a couple of inquiries, and also we'll place plans that ideal fit your needs (paul b insurance medicare explained).Are you newly qualified for Medicare? Medicare works with personal insurance companies to give Medicare advantages.

Medicare Benefit plans also might consist of added benefits, like prescription drugs, regular vision, regular hearing, and regular dental insurance coverage. Despite which protection alternative you may select, you're still in the Medicare program. You still require to stay enlisted in Medicare Part An as well as Component B to get approved for Medicare Benefit or Medicare Supplement.

The Basic Principles Of Paul B Insurance Medicare Explained

Yes, you can maintain your private insurance coverage and also still enroll in Medicare. Medicare is a federal health insurance coverage program for individuals that are 65 or older, people with specific impairments, and people with end-stage kidney disease. Having both exclusive insurance as well as Medicare is referred to as having "twin insurance coverage." It is very important to keep in mind that while you can have both kinds of protection, your exclusive insurance may collaborate with Medicare to pay main or additional for particular services.Medicare protection from Medicare-approved personal insurance provider may cost you an additional monthly premium, but may additionally save you cash in time. You may be stunned to learn that Original Medicare (Component An as well as Part B) has no out-of-pocket maximum. This means that if you require extensive healthcare, you could face massive expenses.

The majority of people with Medicare do pay a costs for clinical site link insurance (Part B) but this premium does not increase or down relying on your age. Location: According to Healthcare. gov, where you live go right here has a huge result on your costs from exclusive insurance provider. The Medicare Component An as well as Medicare Component B costs coincide no matter your place in the United States.

The Best Strategy To Use For Paul B Insurance Medicare Explained

Cigarette use: Cigarette use will certainly not raise your Original Medicare (Part An as well as Component B) costs. According to Medicare.

Many people with Medicare insurance coverage need to certify by themselves through age or handicap. Original Medicare has some considerable voids in protection for points that private insurance usually covers, like prescription drugs. Original Medicare might cover prescription medications you receive in the medical facility or certain medications (such as injections or infusions) you receive in a medical professional's office, yet generally does not cover many prescription medications you take at home.

Report this wiki page